When an unexpected expense hits—like a medical bill, school fee, or car repair—many Filipinos turn to fast cash options without thinking twice. This is where emergency loan alternatives come in. These are safer, regulated, and practical choices compared to risky lending sources.

In the Philippines, countless borrowers fall into debt traps because of payday loans, 5-6 lenders, and unregistered online lending apps. They promise quick approval, but the hidden costs, ballooning interest, and lack of consumer protection can create bigger problems than the emergency itself. The good news? You don’t have to take that route.

Instead, there are SEC-registered, BSP-regulated financial options that provide security, fair terms, and a clear repayment plan. From collateral-based loans like Sangla OR/CR and Sangla Titulo to specialized financing programs such as JUANAsenso,, Filipinos now have access to alternatives that balance speed and safety.

In this guide, we’ll explore the best emergency loan alternatives in the Philippines—how they work, when to use them, and how they compare to payday loans or informal borrowing. By the end, you’ll know exactly which option suits your situation, and where regulated providers like South Asialink Finance Corporation (SAFC) can help.

Why Look for Emergency Loan Alternatives?

Emergencies never knock on your door politely—they arrive suddenly. Whether it’s a medical bill, a car repair, a child’s tuition fee, or even the unexpected cost of a funeral, the need for quick cash can throw your budget off balance. In these moments, many Filipinos feel pressured to grab the first option available, which often means payday loans or borrowing from informal “5-6” lenders.

Here’s the problem: these options may seem like lifesavers at first, but they usually come with sky-high interest rates, unclear repayment terms, and little to no consumer protection. Payday loans, for example, often trap borrowers in cycles of debt because of their short repayment periods and ballooning charges. Meanwhile, loan sharks and unregistered online lending apps can resort to harassment and abusive collection practices when payments are delayed.

The Bangko Sentral ng Pilipinas (BSP) has repeatedly warned the public against transacting with unregulated lenders, stressing that they operate outside of the law and place borrowers at serious financial and personal risk. Instead, BSP and the Securities and Exchange Commission (SEC) encourage borrowers to seek help from registered financial institutions that offer safer, more transparent loan options.

This is where emergency loan alternatives come in—regulated financial solutions that provide both speed and security. By choosing the right lender, you can handle urgent expenses without falling into a debt trap.

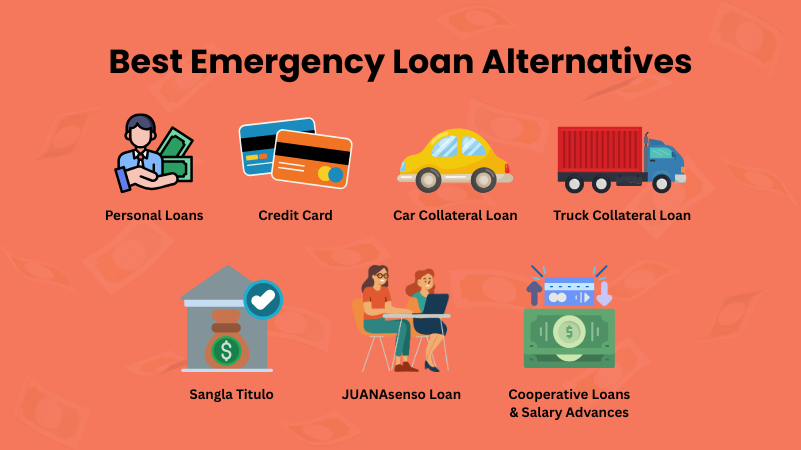

Best Emergency Loan Alternatives in the Philippines

If you’re looking for safe loan alternatives in the Philippines, you’ll be glad to know there are options beyond payday lenders and informal 5-6 schemes. These emergency loan alternatives balance speed, security, and flexibility—so you can cover urgent expenses without risking financial ruin. Below are some of the most practical choices available today.

Personal Loans from Banks & Digital Lenders

A personal loan from a bank or digital lender is one of the most accessible quick loan options in the Philippines, especially for those with good credit history. These loans are usually unsecured, meaning you don’t need collateral, and they come with fixed repayment terms ranging from 1 to 7 years.

Pros: Personal loans often have lower APRs than payday loans, especially if you qualify for bank rates. Repayment terms are flexible, giving you more breathing room to pay without immediate pressure.

Cons: The main drawback is that approval may take a few days, and lenders generally require a good credit standing and stable income. If your emergency needs cash within hours, this option might not be fast enough.

Still, when planning ahead or consolidating debt, personal loans are one of the most reliable and safe loan alternatives PH borrowers can consider.

Credit Card Cash Advances

If you already have a credit card, using its cash advance feature can provide quick access to funds during emergencies. You can withdraw from an ATM or bank branch up to your available credit limit, without a separate loan application.

This is convenient for small, urgent needs like medical prescriptions or utility bills. However, cash advances come with a catch: interest accrues immediately (no grace period), and fees are higher than regular purchases.

Because of this, experts recommend using credit card cash advances sparingly and only when you’re confident you can repay quickly. It’s a short-term bridge, not a long-term solution—still, it’s a regulated option compared to payday loans.

Sangla OR/CR (Car Collateral Loan)

For those who own a car, a Sangla OR/CR loan lets you borrow money using your vehicle’s official receipt (OR) and certificate of registration (CR) as collateral. Unlike informal lenders, this type of loan is SEC-regulated when obtained from licensed finance companies, making it a safe loan alternative in the Philippines.

The advantage is speed—car Sangla loans often release funds faster than banks, sometimes within 1–2 days, with higher approval chances since collateral is involved. Loan amounts also scale with the appraised value of your car, making them useful for bigger emergencies like hospital bills or tuition.

At South Asialink Finance Corporation (SAFC), borrowers can access Car Sangla OR/CR loans with transparent terms, clear repayment schedules, and SEC compliance, ensuring peace of mind during stressful times.

Sangla OR/CR (Truck Collateral Loan)

Truck owners can also access funds quickly through a Truck Sangla OR/CR loan. Similar to car Sangla loans, this option allows you to leverage your vehicle’s OR/CR as collateral. Since trucks often have a higher appraised value than cars, they can unlock larger loan amounts—making them ideal for business-related emergencies like equipment repairs or operational expenses.

Pros: Faster approval than bank loans, higher amounts due to asset value, and regulated if obtained from SEC-accredited lenders.

Cons: Like any collateral loan, you must stay on top of payments to avoid risking your vehicle.

SAFC offers Truck Sangla OR/CR loans nationwide with fair interest rates and flexible terms, giving truck owners a practical and compliant way to handle urgent financial needs without resorting to informal sources.

Sangla Titulo (Property-Backed Loan)

When the emergency requires larger funding—for example, medical surgeries, tuition for multiple children, or family emergencies—consider a Sangla Titulo loan. This option uses your land or property title as collateral, allowing access to bigger amounts compared to personal loans or payday loan alternatives.

Pros: High loanable amounts, longer repayment terms, and lower monthly amortization compared to short-term loans.

Cons: Requires property ownership and longer processing times due to appraisal.

SAFC provides Sangla Titulo loans with clear documentation, fair repayment terms, and SEC compliance. For families or business owners needing significant capital in a short time, this is a safe loan alternative PH borrowers can trust over high-risk informal lending.

JUANAsenso Program

Not all emergencies are personal—sometimes they affect your livelihood. The JUANAsenso program is designed to support Filipina entrepreneurs by offering vehicle-backed loans with low interest rates, flexible terms, and fast approval nationwide. Using a car or truck’s OR/CR as collateral, women can access capital for urgent business or family needs.

This program is unique because it empowers women not only to solve emergencies but also to grow their small businesses. With exclusive refinancing rates and SEC-regulated terms, it’s a safe and practical option compared to payday loan alternatives in the Philippines.

Through SAFC’s JUANAsenso program, borrowers get a combination of empowerment and protection—something informal lenders can never guarantee.

Cooperative Loans & Salary Advances

Another emergency loan alternative often overlooked is borrowing through cooperatives or employer-based salary advances. Many cooperatives in the Philippines offer small loans to members with lenient terms and lower interest rates. Likewise, some employers allow workers to request a salary advance, which can help cover immediate expenses without resorting to high-interest lending.

While these amounts are usually smaller compared to bank or Sangla loans, they are low-risk, quick loan options in the Philippines that don’t trap you in debt cycles. They work best for modest emergencies like utility bills, school projects, or household repairs.

Comparing Emergency Loan Alternatives

When money problems hit, it’s easy to grab the first loan offered — but not all loans are created equal. Some give you fair terms, while others trap you in debt. That’s why it’s important to compare your emergency loan alternatives before deciding.

Here’s a quick comparison to guide you:

| Option | Best For | Risks | Example/Alternative |

| Personal Loans (Banks/Digital Lenders) | Planned big expenses like tuition or medical procedures | Longer processing, stricter requirements | BSP-regulated bank loan |

| Credit Card Cash Advance | Small, urgent needs (₱5k–₱10k) | High fees, interest starts right away | Metrobank or BDO cash advance |

| Car Sangla OR/CR Loan | Medium emergencies, faster than banks | Losing vehicle if unpaid | SAFC Car Sangla OR/CR (SEC-registered) |

| Truck Sangla OR/CR Loan | Business or logistics funding | Same risk as car collateral | SAFC Truck Sangla OR/CR (transparent terms) |

| Sangla Titulo (Property Loan) | Bigger funding (₱500k and up) | Risking property if unpaid | SAFC Sangla Titulo (regulated option) |

| JUANAsenso Program | Women entrepreneurs, family emergencies | Collateral required | SAFC JUANAsenso loan |

| Cooperative Loans/Salary Advances | Smaller, short-term needs | Limited to members/employees | Pag-IBIG MP2, company salary advance |

The key takeaway: Always balance speed, cost, and risk. For example, if you need quick cash but want transparency, a Sangla OR/CR loan from an SEC-registered lender like SAFC may be safer than turning to unregulated payday lenders.

How to Choose Safely (BSP & SEC Guidelines & Red Flags)

The Bangko Sentral ng Pilipinas (BSP) and the Securities and Exchange Commission (SEC) have repeatedly warned Filipinos about the dangers of unlicensed lending apps and informal “5-6” lenders. Many of these charge abusive rates or harass borrowers.

Here’s a quick safety checklist before applying for any emergency loan:

- ✅ Verify registration – Check if the lender is SEC-registered (for financing companies) or regulated by BSP (for banks/e-wallets).

- ✅ Compare APR – BSP reminds borrowers that payday loans often hide extremely high interest. Look for transparent terms.

- ✅ Check reviews – See if borrowers complain about harassment or hidden fees.

- ❌ Avoid 5-6 lending – These are informal, illegal, and often double or triple the loan amount.

- ❌ Don’t share personal info casually – Lending apps flagged by SEC often misuse borrower data.

You can verify licensed lenders here:

- BSP Financial Consumer Protection

- SEC List of Registered Lending Companies

Frequently Asked Questions (FAQ Section)

When it comes to emergencies, Filipinos often ask the same practical questions. Here are clear answers to help you understand your emergency loan alternatives and make safer choices.

Which loan can borrow me money instantly?

In the Philippines, the fastest ways to get emergency cash are:

- Credit card cash advances – Funds can be withdrawn at ATMs right away, though high fees apply.

- Sangla OR/CR (car collateral loans) – Many SEC-registered lenders can release funds within the same day once documents are verified.

- Online salary advances – Some fintech apps partner with employers to release a portion of your salary ahead of payday.

If speed matters most, a Sangla OR/CR loan from a regulated provider like SAFC is often safer than relying on unregulated payday loan apps.

Can I get an emergency loan without collateral in the Philippines?

Yes. You don’t always need collateral to access quick loan options in the Philippines. Some examples include:

- Personal loans from banks or digital lenders – Ideal if you have good credit history.

- Salary advances from employers – Usually interest-free, but limited in amount.

- Cooperative loans – Membership-based lending with more lenient terms.

These are strong payday loan alternatives in the Philippines, since they avoid pawning valuable assets while still providing emergency funding.

Is Sangla OR/CR a safe emergency loan alternative?

Yes, provided you go through an SEC-registered lender. A Sangla OR/CR loan uses your car’s Official Receipt (OR) and Certificate of Registration (CR) as collateral.

Here’s why it’s considered a safe loan alternative in the PH:

- Transparent loan terms regulated by the SEC

- Faster processing compared to personal loans

- Flexible loan amounts based on your vehicle’s appraised value

With SAFC, you can access Car Sangla OR/CR and Truck Sangla OR/CR loans designed to be quick, fair, and compliant with Philippine lending laws.

What should I do if no one approves my loan?

Being denied doesn’t mean you’re out of options. Consider:

- Pawning small valuables like jewelry for short-term needs

- Requesting an employer cash advance

- Joining a cooperative for future loan access

Important: Avoid “5-6” moneylenders and unlicensed lending apps. The BSP and SEC warn that these can trap borrowers with abusive interest rates and harassment practices.

How quickly can I get ₱50,000 in the Philippines?

If you need a significant amount like ₱50,000, here are your quickest routes:

- Sangla OR/CR loans – Often same-day release if documents are complete

- Credit card cash advances – Immediate, but high in cost

- Trusted online lenders – Some release funds within 24 hours

For larger amounts, a Sangla Titulo loan or JUANAsenso program from SAFC can also be practical options, especially if you’re covering medical bills, tuition, or business expenses.

With these FAQs, Filipinos can make informed choices about safe emergency loan alternatives in the Philippines, avoiding risky payday loans while still getting quick financial relief.

Bottom Line

Emergencies are stressful, but you don’t have to settle for risky loans. By exploring safe loan alternatives in the Philippines, you can cover urgent needs without falling into a debt trap.

If you need quick funding with transparent, regulated terms, consider options like SAFC’s Car Sangla OR/CR, Truck Sangla OR/CR, Sangla Titulo, or the JUANAsenso Program. These solutions are designed to give Filipinos peace of mind during financial emergencies — without the unfair practices of unregulated lenders.